Managed Care Plan

Overview

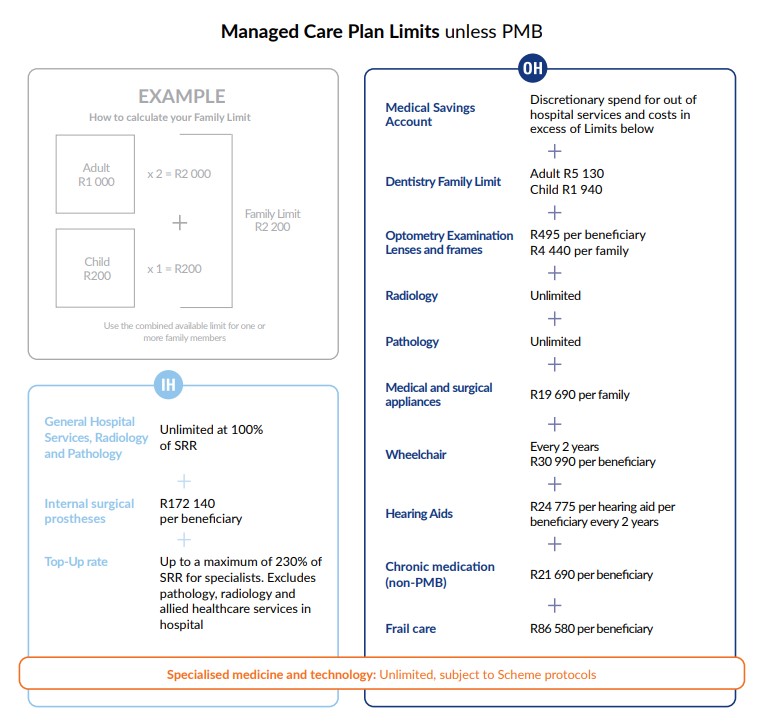

Managed Care Plan offers the following comprehensive benefits:

- Unlimited hospital cover paid at 100% of the Scheme Reimbursement Rate (SRR)

- The Top-Up rate pays up to a maximum of 230% of the SRR for non-network specialist services in hospital, excluding pathology, radiology, allied healthcare services and GPs performing specialist services (230% = 100% SRR + additional 130% of SRR)

- A Medical Savings Account for out of hospital services and discretionary spend

- Unlimited Radiology and Pathology

- Frail care where clinically required

- Extensive chronic medication

- Voluntary use of a GP network (no co-payments)

- Reimbursement for specialist consultations and procedures out of hospital up to 125% of SRR for non-network specialist services

Contributions are split as follows:

- 21% allocated to savings, for discretionary spend.

| Contributions (excluding savings) | ||

|---|---|---|

| Member | Adult dependant | Child dependant |

| R5 560 | R5 560 | R1 290 |

| Savings | ||

|---|---|---|

| Member | Adult dependant | Child dependant |

| R1 480 | R1 480 | R340 |

| Total contribution (including savings) | ||

|---|---|---|

| Member | Adult dependant | Child dependant |

| R7 040 | R7 040 | R1 630 |

*2025 benefits and contributions as approved by the Registrar for Medical Schemes.