Standard Care Plan

Overview

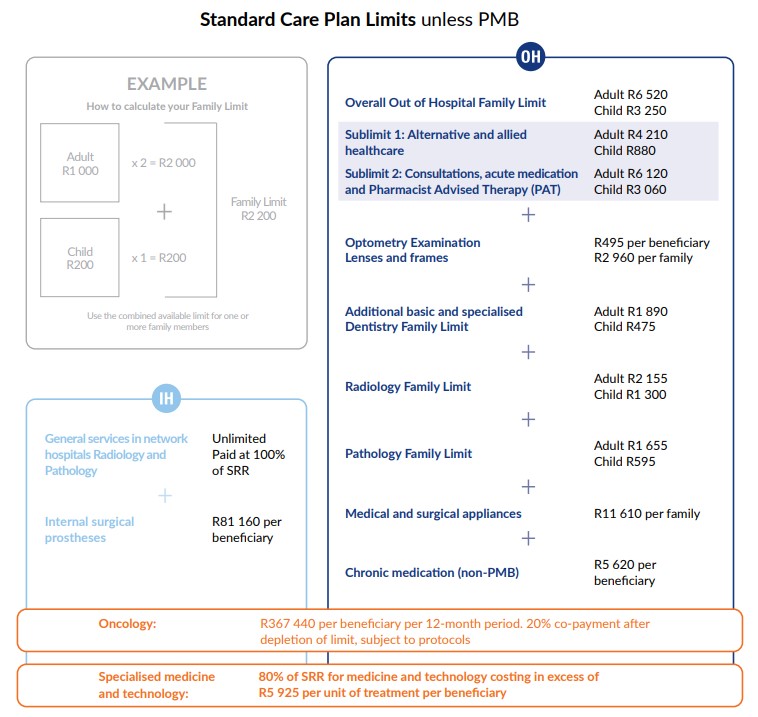

The Standard Care Plan is a traditional medical plan with defined benefits and Out of Hospital Family Limits and certain network limitations.

Out of hospital benefits are limited and grouped by service under individual limits. Unless it is a Prescribed Minimum Benefit (PMB), all benefits are paid at 100% of the Scheme Reimbursement Rate (SRR):

- The SRR is based on the previously negotiated rate between medical schemes and providers

- Providers are entitled to charge above the SRR

- Members are encouraged to request the actual costs of services before purchasing them and to compare with the SRR

- Obtain a quotation from your provider and call 0860 222 633 to receive an estimate of the SRR

- Members may negotiate a better rate with their provider

Hospital cover is unlimited and paid at 100% of SRR in network facilities. If you use a non-network facility, a co-payment will apply.

| Contributions 2026 | ||

|---|---|---|

| Member | Adult dependant | Child dependant |

| R3 855 | R3 855 | R1 155 |

*2026 benefits and contributions are approved by the Registrar for Medical Schemes.

Contributions subject to underwriting.