Healthcare billing and Scheme Reimbursement

You know how important it is to understand the cost of an upcoming procedure or hospital event in advance. It not only gives you the opportunity to budget appropriately, as sometimes you might have to contribute to the costs with co-payments, but also to negotiate with your healthcare provider.

AMS’s Call Centre is one of the few in the country that applies a patient advocacy philosophy. Our agents will assist you by explaining what the Scheme will pay for your procedure. They will even offer to engage with your healthcare provider on your behalf.

Use the knowledge and experience of the Call Centre agents – it will also help to understand the technicalities of how healthcare providers bill and how the Scheme funds for these services. This is a very complex process with many variables that are not always easy to understand; not only for members, but even for people working in the healthcare industry, as they might only know their side of the billing process. Medical billing is in fact a scarce skill in South Africa – we don’t have enough professionals in this field.

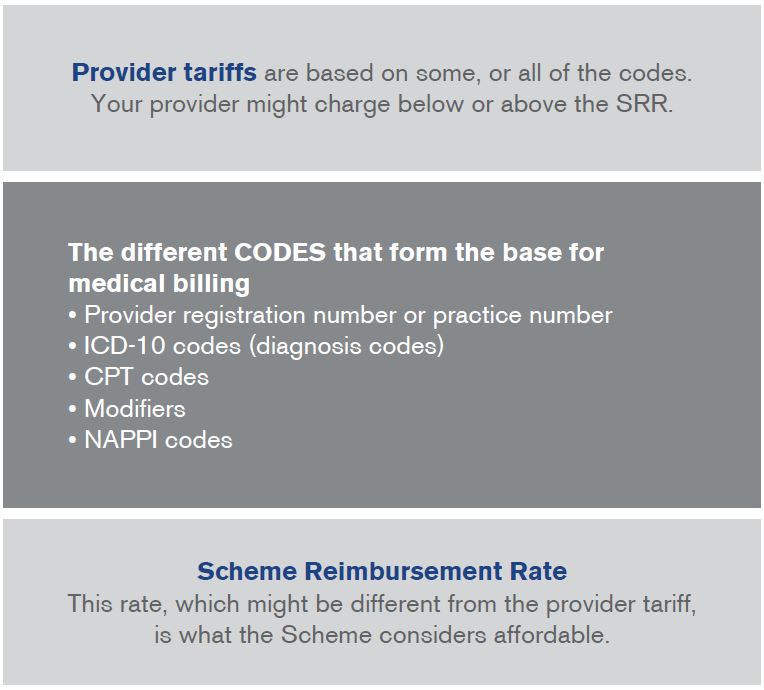

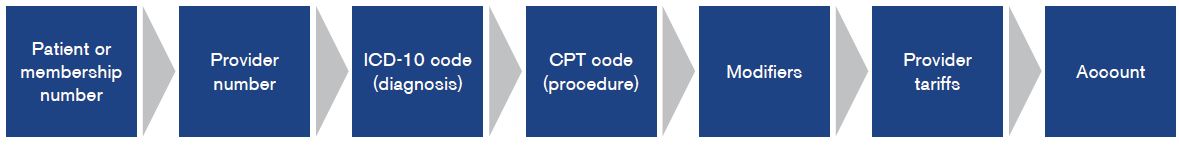

There are different complexities in medical billing. When you visit your healthcare provider you will get a diagnosis, possibly have a procedure done and finally receive treatment or medication. The expected billing process would be determined by the provider concerned and the procedure performed – each component of which would be coded (as illustrated below). The tariff, or charge, is the rate the provider attaches to the procedure performed.

A unique complexity of medical billing in South Africa is our Prescribed Minimum Benefit (PMB) conditions. Let’s say your GP or the paramedic believe you are having a heart attack – which is a PMB – and you are admitted to hospital with that ICD-10 code and after investigation, doctors find it was not a heart attack but in fact a stomach ulcer mimicking a heart attack. This might then not be a PMB condition and will be billed and reimbursed differently. It would change the entire account submitted by the healthcare provider, as the ICD-10 code for a heart attack is different to the final diagnosis.

Another complexity is that the amount providers charge for their service is not necessarily what the Scheme considers to be affordable for their members. The provider has the right to set their own rates, which might depend on supply and demand of this provider, group of specialists or the geographical area.

The difference between the provider tariff and the Scheme Reimbursement Rate (SRR) is what you might experience as a co-payment.

And then there’s the complexity of all the different codes needed to correctly bill for services provided.

Simplified billing information and process

- Tariffs are the rates (rand amounts) that providers decide to charge for their service, against set codes, such as the CPT or Nappi codes (except medicines which are subject to the Single Exit Price).

- Provider registration number or practice number describes the discipline of the provider and is unique to each provider.

- ICD-10 codes (International Classification of Diseases) describing a condition.

- CPT (Current Procedural Terminology) codes describe the service rendered by medical practitioners.

- Modifiers – different modifiers are used per Scheme and per healthcare provider. For more detail see below.

- Nappi codes (National Pharmaceutical Product Index) are identifiers for surgical or medical consumable products and medicines.

- Single Exit Price is a regulated maximum price that a medicine can be charged at.

- Dispensing fee is an additional fee that dispensers (pharmacies or doctors) may charge depending on the price of the medicine. The maximum fee is regulated.

- Scheme Reimbursement Rate (SRR) – this is the rate the Scheme considers to be affordable for its membership and might be lower or higher than the provider tariff.

There are about 8 000 different CPT codes, over 450 000 NAPPI codes, 70 000 ICD-10 codes and many modifiers. You can imagine that if one of the codes is missing, not correct or not agreed on, this might change the account and how the Scheme reimburses these services.

The role of modifiers

You might find, that although you had a quote from your healthcare provider before the event, the charges might be higher than expected afterwards, leaving you in doubt about whether you have been correctly charged or wondering why you couldn’t get a more exact quote. You might recognise the problem from other, non-medical, life situations. You thought you were in for a simple repair on your car or house and landed up with much more work to be done than what you anticipated, but had to be attended to once you opened the bonnet or started construction. The unknown part of your healthcare quote is what doctors find on the day. This might be influenced by your body, health or circumstances unique to your event.

It would be easier to understand how the Scheme reimburses claims if every procedure and every patient’s circumstances were the same. But as this varies, the standard codes might need to be modified. Doctors might have to add additional codes for your individual set of circumstances.

These variables are called modifiers. It has become important to give you more information on modifiers in this issue as this has been raised by members as being in need of clarification.

A modifier is an extension of a procedure code. It can make your healthcare service more expensive or less expensive. The modifier indicates additional detail regarding a procedure or service provided by a doctor and explains why the service, in your case, is more or less expensive. Under certain circumstances, it may be necessary to distinguish between procedures or services performed on the same day.

Modifiers might reflect your unique risk factors, i.e. other comorbidities (other conditions you might have) that could make a procedure more difficult, therefore complicating the management thereof. This might add additional amounts to your claim in your unique condition. Modifiers might also change the value of another tariff code on the claim, which will require further calculation of the payment.

When a modifier is quoted on a claim, the first step is to establish what kind of modifier it is. Does the modifier add an amount to a procedure, add an amount to the claim, reduce the value of a procedure or is it just for information? You might have seen Reason Code 324 on your statement “We may have changed the Scheme rate on this claim line so that we could pay the maximum recommended scheme rate”. This reason code might have been applied to indicate which lines have been affected by the calculation as a result of the use of a modifier.

While a modifier claims standard exists, not all providers comply with this standard as it is a guideline only and as such we may get the same modifier billed differently by different providers. To avoid inconsistent payment to healthcare professionals, we apply modifiers uniformly across all claims.

As you see, billing for healthcare services can be quite complicated! If you need assistance with understanding the detail, our Call Centre team is here to help. We understand that if you need medical assistance, the technicalities of the billing are the last thing you want to worry about, but that’s why we are here to assist you