Benefits and contributions for 2020

As South Africa embarks on the journey to establish a National Health Insurance, the future role of medical schemes and when or what benefits will be delivered by NHI is still uncertain. It therefore remains the Trustees’ duty to guard the Scheme – keeping it on course to deliver the promise made to its members. In the meantime, it is no secret that South Africa’s private healthcare is getting more and more expensive and that technology is advancing faster and becoming more costly than patients can afford. Our macro economy remains weak with investments giving low or no returns. As AMS relies on interest and dividends to fund about 40% of all claims received, when the Scheme investments fail to perform, the reserves begin to decline. The benefits that were increased a few years ago are becoming unaffordable and, although the Scheme is still in a very solid position, if we are to remain viable over the long term, the time has come to implement certain measures to keep it that way. Rather than increase contributions to keep pace with the rising costs, benefits have been adjusted and, where possible, the Scheme has aimed to obtain better pricing for services from providers, which come with certain constraints as outlined below.

Value Care Plan

Value Care Plan is a small, tightly managed network option that focuses on primary healthcare, and no major benefit adjustments were necessary this year.

Standard Care Plan (SCP)

If you have ever compared SCP to other plans with similar contributions, you will have noticed that most have limited, strictly managed benefits for many disease conditions and are restricted to network providers. These are all measures to keep contributions as affordable as possible. AMS has considered the measures available and will be adopting a few, in line with the industry, to keep increases below 10% in 2020 while maintaining the “better than market” benefit offering.

1. Cancer (Oncology) benefits

From 2020, if you are on the Standard Care Plan, you will have access to an oncology benefit of R300 000 per beneficiary, over a 12-month period. Once the limit is reached, the Scheme will cover 80%, and you will be required to contribute a 20% co-payment towards all treatment costs. Access to care remains unlimited. If you are already registered on the oncology management programme, you will receive individual correspondence on how the change affects you, if at all.

2. Hospital Network

The Scheme is introducing a Hospital Network comprising 150 private hospitals and day clinics that SCP members can choose from for planned admissions. If a member chooses a non-network hospital, a co-payment of R3 200 will apply. If a member is admitted to a non-network hospital in a medical emergency (where a patient’s life is in danger), no co-payment will be required. The current co-payment (valid until December 2019) for hospital admissions falls away in 2020. The list of hospitals will be available on www.angloms.co.za and from the Call Centre. Please check your nearest hospital, which should not be more than 35 km from either your residence or your place of work and, where needed, make sure you visit a specialist who works from that hospital.

3. Medicine for non-PMB chronic conditions

The list of covered non-PMB chronic conditions was updated for 2020 to adjust to our members’ needs. Two new qualifying conditions were added and 22 conditions were removed. A very small number of members will be impacted and will receive individual correspondence on how it will affect them.

4. Specialised Medicine and Technology (SMT) benefit

The Scheme has introduced a new benefit for costly specialized medicine and technology, giving members in need (against certain clinical criteria) access to these advancements. SCP members will contribute to the costs with a 20% co-payment.

Managed Care Plan

1. Medical Savings Account (MSA) allocation

Before 2015, the contribution percentage allocated to the savings account was 21%. In 2015 the Scheme increased the percentage to 25% and the cost impact was funded from the reserves. As the investment returns have not kept pace with the investment income assumed at that time, the allocation will revert to 21% from next year. Without this reduction, the contribution increase would have been approximately 5% higher, which, for a significant number of our MCP members who do not receive a contribution subsidy from their (ex)employers, would have been unaffordable. As many of these members are pensioners, the higher contribution increase had to be prevented.

2. Interest earned on positive savings-account balances

The MSA interest paid to our members with positive savings will be pegged at the prevailing repo rate, currently 6.5%.

3. Specialised Medicine and Technology (SMT) benefit

Members on the MCP, meeting certain criteria, will have access to the new benefit for costly specialised medicine and technology without a co-payment.

All benefit limits on all plans will be increased by 5% for 2020.

Contributions

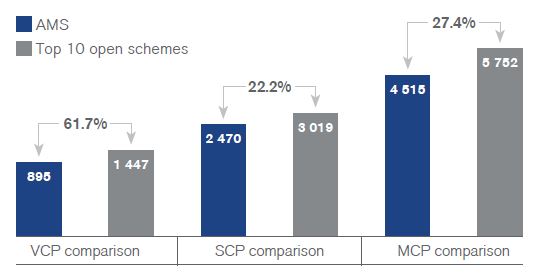

AMS contributions are still competitively priced, with contribution rates significantly below comparable schemes in the market. The diagram below shows AMS’s 2019 contributions, the blue columns measured against the average contribution rate across the top ten similar schemes per category.

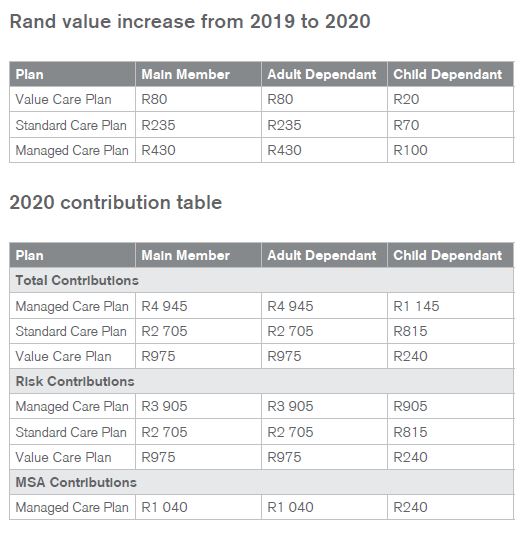

The 2020 AMS contribution increases will continue to be in line with the market, reflecting the current pressures in our economy and healthcare industry. VCP will have an increase of 9%, SCP and MCP will have an increase of 9.5%. Rand value increase from 2019 to 2020

You will find more details on the changes in benefits and contributions for 2020 in your Benefit Guide and Scheme Rules, available on www.angloms.co.za, once approved by the Council for Medical Schemes. (All 2020 benefits and contributions are subject to the approval of the Council for Medical Schemes.)