2019 contributions and benefits

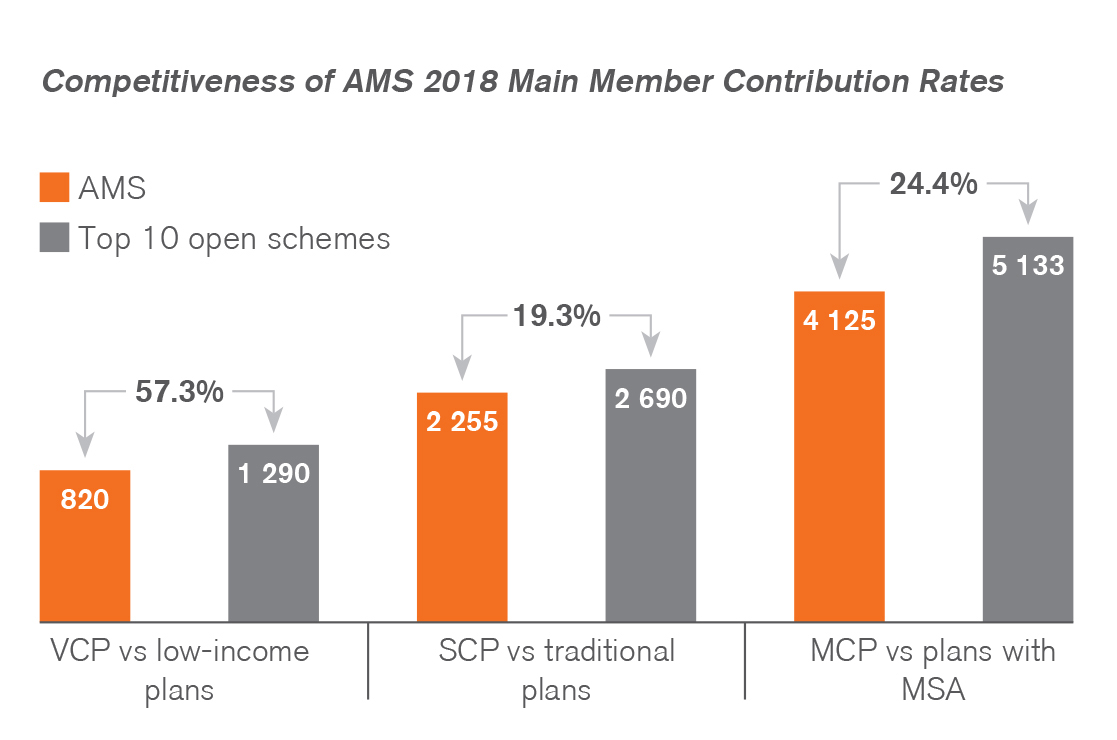

With the year-end looming you will be pleased to hear that the structure of the AMS benefits will not change in 2019 and the value our plans offer still compares very favourably with our 'competitors'.

Benefits in 2019

In line with the industry, all benefit limits will increase by an estimated CPI (Consumer Price Index) rate of 5%. Co-payments for endoscopies and cataract surgeries performed in hospital will not increase in 2019 but will remain at the 2018 value. (You can avoid these co-payments altogether by using a day clinic).

2018 claims cost and the utilisation of our reserves to keep contributions low

Contribution increases that are higher than CPI continue to be a concern for our industry. Factors that determine these increases are largely grouped into:

- medical inflation (increase in doctor rates, advances in treatment, etc.);

- utilisation (number of visits to service providers i.e. doctors and hospitals); and

- non-healthcare costs (administration, managed care, etc.).In 2018 the VAT increase also impacted the cost of claims, but at the time of the VAT increase AMS did not adjust contributions as other schemes did.

The AMS financial experience from January to August 2018 indicates that we will end the year within budget. This is possible because, in addition to all the contributions received, we used an estimated R135 million from the reserves to pay members' claims. Hospital admissions and the cost of hospital services are again the main drivers of the increased costs. Currently, hospital costs are 15.8% higher than in 2017. We anticipate this trend to continue next year as our members age and as new and more expensive technology and medicines become available. The second part of the financial analysis undertaken by AMS is the impact of these changes on the reserves. As you are no doubt aware, we are unique in the industry: AMS is the only medical scheme that has sufficient reserves to be able to keep paying amounts such as R135 million each year to cover the shortfall between the actual amount claimed by members and the contributions received.

Your board carefully considers how much can be paid from the reserves and how much is needed to be paid by members in the form of contributions to remain viable into the future. The 2019 increase was determined to be 9.5% to meet both these requirements.

2019 contributions

| Risk Contributions | Main Member | Adult Dependant | Child Dependant |

| Managed Care Plan | R3390 | R3390 | R785 |

| Standard Care Plan | R2470 | R2470 | R745 |

| Value Care Plan | R895 | R895 | R220 |

| MSA Contributions | Main Member | Adult Dependant | Child Dependant |

| Managed Care Plan | R1125 | R1125 | R260 |

| Standard Care Plan | R0 | R0 | R0 |

| Value Care Plan | R0 | R0 | R0 |

| Total Contributions | Main Member | Adult Dependant | Child Dependant |

| Managed Care Plan | R4515 | R4515 | R1045 |

| Standard Care Plan | R2470 | R2470 | R745 |

| Value Care Plan | R895 | R895 | R220 |

Rand value increase from 2018 to 2019

| Option | Main Member | Adult Dependant | Child Dependant |

| Managed Care Plan | R390 | R390 | R90 |

| Standard Care Plan | R215 | R215 | R65 |

| Value Care Plan | R75 | R75 | R20 |

Plan change – 14 December deadline

If you consider switching plans for reasons such as a change in income or medical needs, please consult your Client Liaison Officer or Pay Point Consultant. You can only switch plans at the end of the year and would have to stay on the new plan for the next 12 months, which makes it even more important to understand the financial impact and which benefits will be available. To change your plan, submit your plan-change request by 14 December at the latest to your employer or past employer, or, if you are a direct-paying member, directly to the Scheme. Your HR or pension office can only submit your request until the 31 December to the Scheme.

2019 Benefit Guide

The new Benefit Guide will be posted to you at the beginning of November. It will provide you, as usual, with detailed information about your benefits for the coming year. You will also be able to access the Benefit Guide on www.angloms.co.za.