2017 Contribution increases

The good news is that benefits on all plans remain unchanged and our contribution increases are market related.

So why the higher increases this year?

The September MediBrief provided insight into the significant increase in healthcare costs. Total claims paid by the Scheme increased by 11% year-on-year, with hospital and specialist costs increasing the most. Overall medicine costs increased by 11.7% per beneficiary, largely due to high oncology costs, the 2.5% increase in the number of medicines used per patient and the 4.8% increase in the Single Exit Price (SEP) added to the higher year-on-year costs.

How can we manage and reduce healthcare costs?

- The Scheme offers a patient advocacy programme, assisting members to plan, compare and save costs. Always ask your healthcare provider for an estimated cost of a procedure and then speak to a Call Centre agent on how to reduce your out-of-pocket expenses and extend your benefits.

- The Scheme benefits from our administrator's 'buying power'. Through the Discovery Health administration, hospital costs are already tightly managed and rates are negotiated aggressively.

- Many procedures don't need to be done in hospital, but could take place in a day clinic, offering routine procedures at much more competitive prices. You will find more information about day clinics in the next issues of MediBrief.

- Many services could be provided by GPs instead of specialists. Always consult your GP as the first port of call.

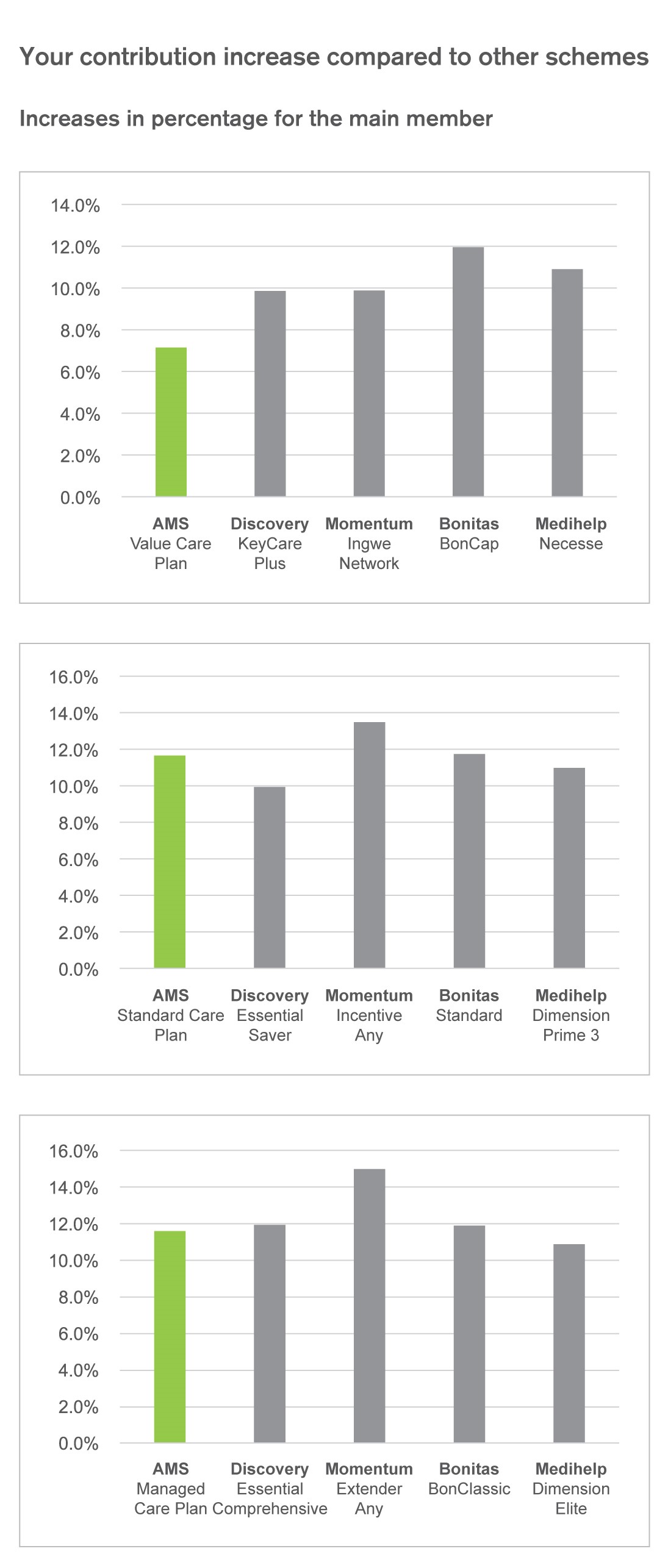

AMS contributions remain competitive in 2017

The Scheme plans to subsidise member contributions for the next 30 years. In 2017, R150 million of reserve money will be used to meet the shortfall between claims payments and contributions. Benefit limits and the Scheme Reimbursement Rate (SRR) will increase by 6% on the Managed Care and Standard Care Plans. Even with money utilised from the reserves, contributions for the Standard and Managed Care Plans need to be increased by 11.5% to keep pace with claims costs. The Value Care Plan has experienced lower claims and contributions will only be increased by 6.8%.

2017 Contributions* per plan

| Plan | 2016 | 2017 | Difference in Rand |

| Value Care Plan | |||

| Main member total | R700 | R750 | R50 |

| Adult dependant total | R700 | R750 | R50 |

| Child dependant total | R175 | R185 | R10 |

| Standard Care Plan | |||

| Main member total | R1 845 | R2 060 | R215 |

| Adult dependant total | R1 845 | R2 060 | R215 |

| Child dependant total | R555 | R620 | R65 |

| Managed Care Plan | |||

| Main member total | R3 405 | R3 800 | R395 |

| Adult dependant total | R3 405 | R3 800 | R395 |

| Child dependant total | R785 | R880 | R95 |

| Main member savings | R790 | R950 | R160 |

| Adult dependant savings | R790 | R950 | R160 |

| Child dependant savings | R185 | R220 | R35 |

*Subject to approval from the Council for Medical Schemes

PLAN CHANGES: If your health needs or income have changed and you are considering changing plans for the coming year, you may do so at the end of the year. We urge you to speak to one of our Client Liaison Officers (CLOs) or your Paypoint Consultant for advice. Your plan change form is included in the back of the Benefit Guide and must be handed to your employer or past employer before 31 December. Direct-paying members must submit their forms to the Scheme.

The 2017 percentage increases are in line with the industry, as shown in the graphs below. As the current Anglo Medical Scheme benefits are about 15% richer than these products, you still pay less for more.